According to MoneySavingExpert, inflation is currently running at 10%, yet student maintenance loans have only risen by up to 4% since last year. Therefore, as a university student with a measly student loan, it has been particularly important for us to budget carefully each month to ensure that we are not overspending on unnecessary purchases. This blog post will include some of the things I have been doing to ensure I am sticking to my budget, and provide some advice for others that may be struggling during this stressful time of our lives.

Use cash

Using cash has been a great method for me to stick to my weekly allowance. If you are heading on a night out with a small budget, it may be tempting to overspend when using contactless is so easy; we may not even realise the amount we have spent adds up to so much. By withdrawing a set amount of cash to bring with you (you can even leave your card at home, if you feel you cannot trust yourself), this will make us more aware of what you are spending and once it has been spent, there is no option to overspend. I also find this is a good way to see what I have for the remaining days of the week or month – I have to think about spending money more when it’s physically in my hand!

Buy Second Hand

Buying second hand is one of my favourite ways to make purchases, and it is becoming increasingly easy to find great items with sites such as Ebay, Vinted and Depop. Not only can you find some great bargains, you are doing your bit for the planet by not contributing to the production of more clothing and increased landfill. Charity shops are also a great way to keep your budget down if you are needing a new outfit; one of my favourite skirts is an item I bought from my local charity shop – which I paid £2.99 for!

Saving goals

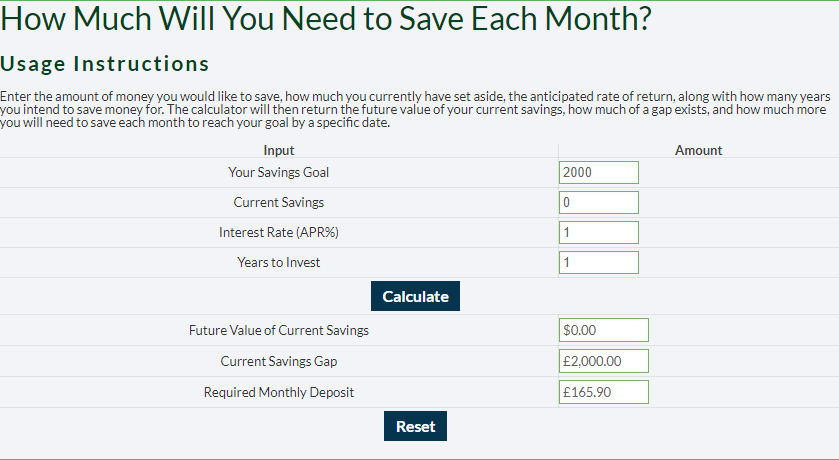

We never know what’s around the corner; life can throw us curveballs when we least expect it. For this reason, I always like to save a bit of money each month if I can – though it is not always possible. This could be saving just for a rainy day, or perhaps a holiday/slightly bigger purchase like a car. You can obviously use a spreadsheet or similar to do this, but if you’re like me and like to make things much easier for yourself, there are great calculators online to make the process easier. I tend to use savingscalculator.org because it allows you to choose your currency and include an interest rate amount on savings each month, so I just input how much I’d like to save over what period of time and include the interest rate and it tells you straight away how much you’d need to save. This is super handy if you’re going abroad or want to see how much interest you will accrue along with your deposited money, without the added maths chaos! This website also provides a calculator to see how long it would take you to reach your savings goals, by inputting your chosen amount deposited per month.

I find having that extra money in a savings account just gives me that bit of extra security incase something goes wrong on one month and you hit a particularly expensive period – it saves so much stress to have something to fall back on. I am also saving for a holiday and wanted to put around £2000 towards it this year, so I used this calculator to help know how much I need to deposit in to my savings account each month to ensure I hit that figure in 12 months time (which worked out at £165.90!)

Get a student bank account

Student bank accounts provide some great benefits such as cashback, discounts or interest-free overdrafts. When I first opened my student bank account, I was able to migrate it with my standard current account and got £100 in cash just for the transfer! That extra bit of cash is always a great help whether you’re trying to save more each month, or just for that extra wiggle room in your normal day to day purchases. Some student accounts also offer a taste card or free rail cards; these are a great way to save money on eating out and travel.

Make Use of Student Discounts

Leading on from the student bank accounts, there are so many brands that offer discounts for students these days. Some of the better ones I’ve come across are:

- 6 months free amazon prime

- 35% off dominos

- Student art pass for £5 – providing you free entry into hundreds of museums and galleries

- 16-25 rail card available for students over 25

- 50% tenpin bowling

There are of course hundreds of different stores that offer discounts – usually offering between 10 and 20% off. It is always worth asking at every shop you make a purchase in to make your pennies go a little bit further. Often you only need to show your ID card, however there are apps too such as UniDays and StudentsBeans which can provide you with a code for online shopping.

I hope these tips have been helpful for those of you, like me, have been trying to be stricter in their budget this year. For university students in particular, it has been more important than ever to ensure we are not spending money unnecessarily so hopefully these points will help you out like they have helped me!